Sigmify GRC helps you comply with the guidelines prescribed by the regulatory authorities.

RBI

The Reserve Bank of India (RBI) recently released guidelines on Information Technology governance for Regulated Entities (REs) like banks, non-bank financial companies, credit information companies, and other financial entities.

Here is how Sigmify GRC helps you with compliance.

The Sigmify GRC solution is Comprehensive.

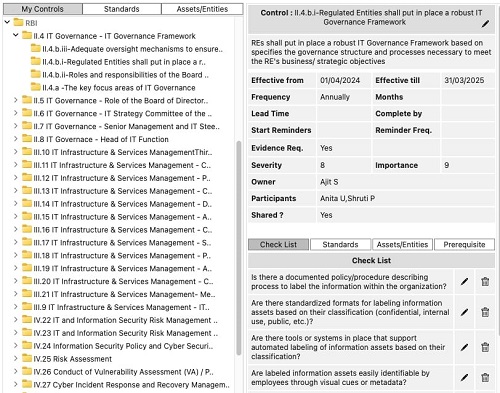

It provides a ready-made library of domains, controls, and checklists. The setup helps in setting the auto-generation parameters such as the effective period, frequency of the compliance, lead time for completion, and evidence gathering. It helps assign the controls to the responsible people in the organisation and their teams.

The team of experts constantly scans the environment and provides updates to these libraries.

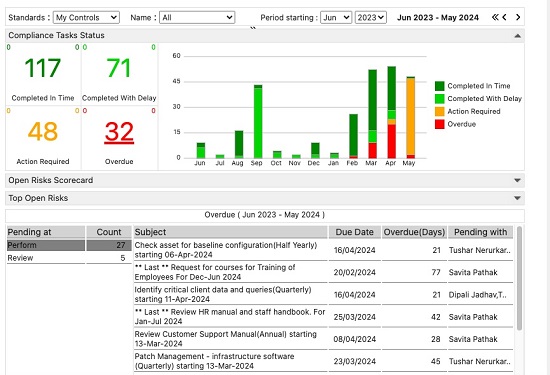

Sigmify GRC provides Assured results by gathering evidence of task completion, creating status dashboards, risk score cards, and reports to be presented to the authorities.

Sigmify GRC improves visibility across the organization with the stakeholders, the executive committee, and the board. It reduces the time for remediation. It reduces the risk to reputation, penalties, and overall disruption in the business.